A Profound Gift

That Transforms Lives for Generations

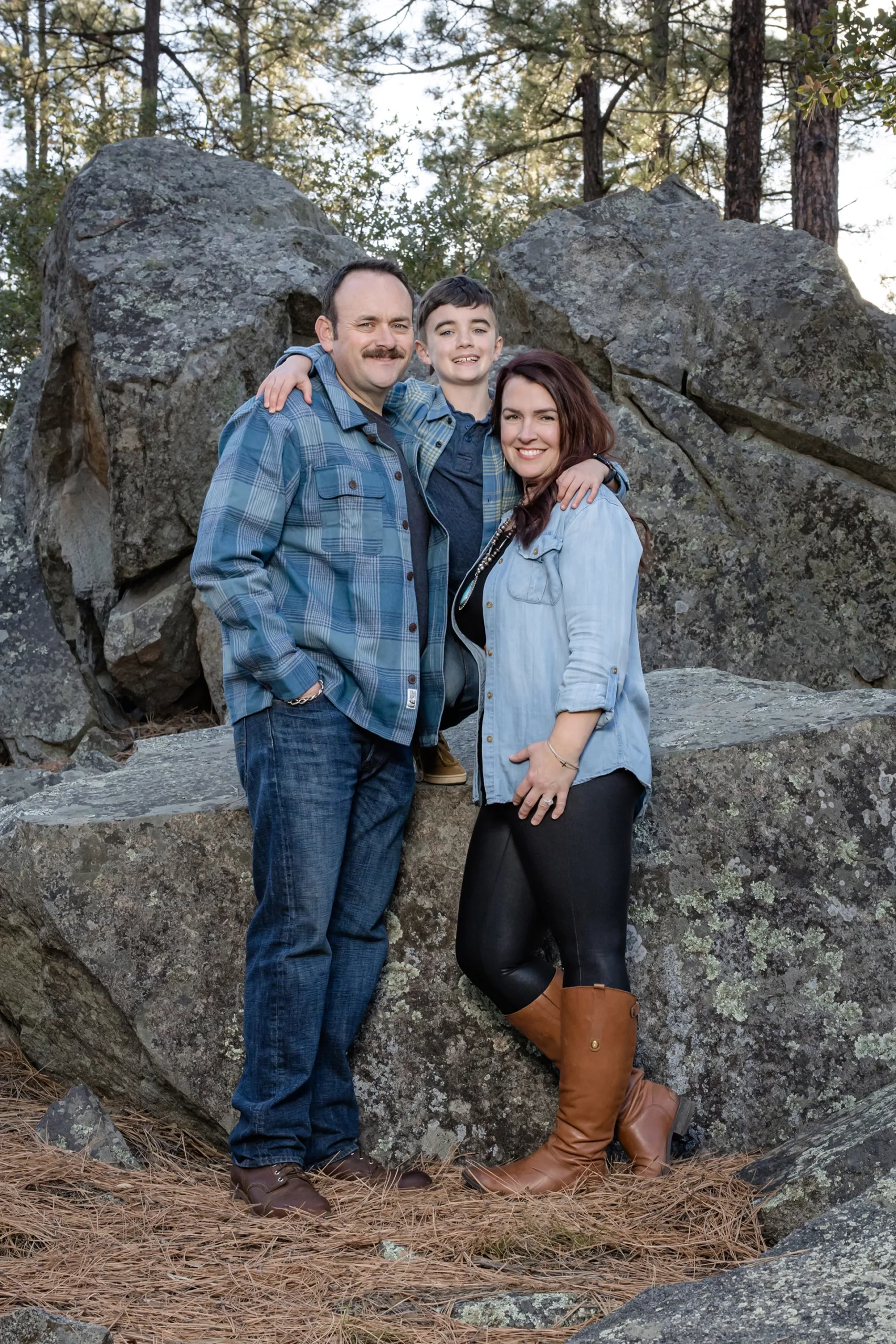

When you donate your home, real estate investments or land to Home for Good Foundation, your generosity is multiplied and protected in perpetuity. A gift of real estate is much more than just giving property—you’re building a legacy of transformative impact for generations to come. Your gift will provide housing for individuals and families who need stability and security. Depending upon your preferences, we can customize your gift to also provide long term, sustainable funds to your family or heirs, your church or a beloved charitable cause.

Tax Benefits

Donating your home offers a powerful way to give back while receiving significant tax benefits. As a 501(c)(3) nonprofit organization, we can accept your home donation, which may entitle you to a charitable tax deduction. Donating property may also allow you to avoid capital gains taxes and estate taxes, making it a financially smart decision that supports both you and your community. For a comprehensive understanding of the financial benefits, please consult with your tax advisor. They can help you navigate potential tax deductions and other advantages specific to your situation.

Preserving Affordability

When you donate your home, we ensure that it remains affordable and protected from market forces that can lead to displacement. The land trust model means that your home will be used for long-term housing, permanently keeping it within reach for those who are working to provide for their families and contribute to our community. Your generosity helps build stronger, more resilient communities. Forever.

If you’re going to live, leave behind a legacy. Make an impact on the world that can never be erased.”

– Maya Angelou

How It Works

Contact us to learn more about donating your home. Our team will guide you through the process, answer your questions, and help you understand how your donation can benefit your personal goals and lay the groundwork for a healthy community.